Winning something—whether it’s a cash prize, a car, or even an exotic vacation—is a moment to celebrate. But before you get into enjoying your newfound fortune, there’s an important reality to face: taxes. Yep, the IRS sees winnings as taxable income. Let’s seewhat that means for your prize and how to prepare for it.

Taxing Your Winnings

When you win something, the IRS considers it income, and income i

s taxable. The type of prize—cash, property, or a service—doesn’t matter. Whether you’re a game show champion, a lottery winner, or the recipient of an employer award, taxes come into play.

For example, if you win a cash prize of $10,000, that entire amount is subject to income tax. On the other hand, if you win a new car worth $30,000, you’ll owe taxes on the car’s fair market value. Either way, your windfall comes with a tax bill.

Federal taxes treat all winnings as ordinary income, meaning they’re taxed at the same rate as your paycheck. The tax rate depends on your total income for the year, so a big win could push you into a higher tax bracket. States often get in on the action, too, unless you live in a tax-free state like Florida or Texas.

How Winnings Are Reported

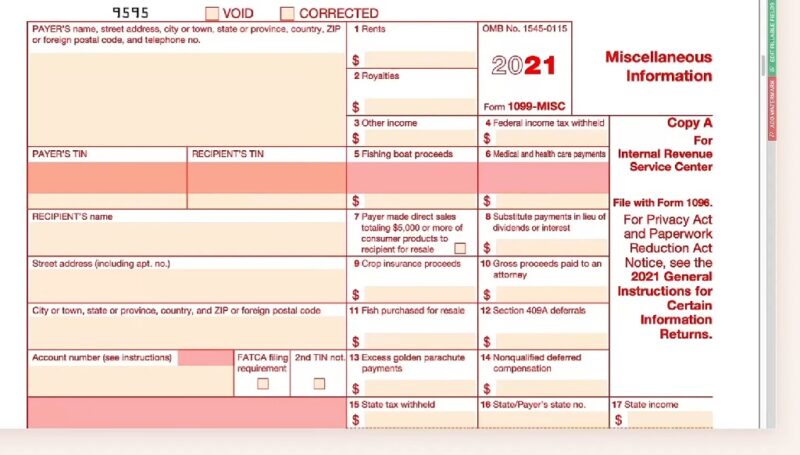

Winnings don’t magically show up on your tax return; they’re reported to you—and the IRS—via specific forms:

- Form 1099-MISC: This is the go-to form for reporting most non-gambling winnings. Prizes from contests, sweepstakes, or any award over $600 typically show up here.

- Form W-2G: For gambling-related prizes, like lottery winnings or casino jackpots, you’ll get this form if your prize meets certain thresholds (e.g., $1,200 for slot machines or $5,000 for poker tournaments).

Even if you don’t receive a form, you’re still responsible for reporting the winnings on your tax return. Ignoring it can lead to penalties, interest, or even audits down the line.

How Much Will You Pay?

The exact amount of tax you’ll owe depends on your total income. Let’s break it down with an example:

Imagine you make $50,000 a year and win $10,000 in a raffle. Your total income is now $60,000. If you’re in the 22% federal tax bracket, you’ll owe roughly $2,200 in federal taxes on the winnings. On top of that, your state might take a percentage. For instance, New York taxes lottery winnings at rates up to 10.9%.

For big wins, like a million-dollar lottery prize, the numbers can get even more eye-popping. A lump sum payment of $1 million could push you into the top federal tax bracket of 37%. That means $370,000 in federal taxes alone, not counting state taxes. Yikes!

To Withhold or Not to Withhold

For larger prizes, the payer may withhold federal taxes upfront—typically 24%. While this might seem like a lot, it’s often not enough. Big prizes can push you into higher tax brackets, so you may need to make estimated tax payments or set aside extra money to cover the difference.

For instance, if you win $500,000 in a lottery and the payer withholds 24%, that’s $120,000 withheld. But if your total tax bill is closer to $185,000, you’ll owe an additional $65,000 come tax time. It’s a good idea to consult a tax professional to figure out the right amount to save or pay in advance.

Lump Sum vs. Annuity: What’s Better for Taxes?

If you win a substantial prize, like the lottery, you may have the choice between receiving a lump sum or an annuity. Both options have distinct tax implications:

- Lump Sum: You get all the money at once, but you also pay taxes on the entire amount in the year you receive it. This often means being pushed into the highest tax bracket.

- Annuity: Payments are spread over several years, which can keep you in a lower tax bracket. However, future payments could be subject to changes in tax laws.

Deciding which option is better depends on your financial goals, current tax situation, and even inflation. A financial advisor can help you weigh the pros and cons.

Employee Awards: Special Rules

Awards from your employer, like those for service milestones or safety achievements, may be taxable too. However, the IRS allows certain non-cash awards to be excluded from taxable income—provided they meet specific criteria. For example, a gold watch valued under $1,600 might qualify as tax-free, while a cash award would not.

Gambling Winnings and Losses

If you’ve had a lucky streak at the casino, it’s important to know how gambling winnings are taxed. Any amount you win, whether it’s $5 at the slots or $50,000 at the poker table, is considered taxable income. For substantial prizes, such as those exceeding $1,200 from slot machines or $5,000 from poker tournaments, the casino will typically issue a Form W-2G, which reports your earnings to the IRS.

Keep in mind that taxes might be withheld on the spot for large wins, usually at a rate of 24%. Even so, that might not cover the total tax bill, especially if the winnings bump you into a higher bracket. If you’re gambling regularly, you can also deduct your losses—but only up to the amount of your reported winnings. Just be sure to keep detailed records, like receipts and bet slips, to substantiate those deductions.

There are plenty of resources out there to help gamblers stay informed about their obligations and track everything accurately. For instance, platforms like CasinoMIRA discuss tips on organizing records and understanding tax rules, making the process feel less overwhelming for anyone who enjoys a casino outing. It’s worth knowing where to turn when you want to ensure everything is handled smoothly without any added stress.

Planning Ahead

Winning big is exciting, but it also comes with financial responsibility. Here are some tips to handle the tax side of your good fortune:

- Save for Taxes: Set aside a portion of your winnings to cover federal and state taxes.

- Consult a Tax Pro: They can help you understand your tax obligations and even identify strategies to reduce your tax bill.

- Keep Records: Whether it’s gambling winnings or a sweepstakes prize, documentation is key to accurate reporting and avoiding penalties.

- Consider Charitable Contributions: Donating a portion of your winnings could lower your taxable income while supporting a good cause.

Final Thoughts

Winning a prize or award is a life-changing event, but it’s crucial to handle the tax implications carefully. With proper planning and professional advice, you can enjoy your winnings without unwelcome surprises. After all, the goal is to celebrate—not stress—your big win!